How to set up your Director ID

Directors are now required to register for a unique identification number that they will keep for life.

What is a director ID?

A director ID is a 15 digit identification number that, once issued, will remain with that director for life regardless of whether they stop being a director, change companies, change their name, or move overseas.

The introduction of the Director Identification Number (DIN) is part of the Government’s Modernisation of Business Registers (MBR) Program creating greater transparency, and preventing the potential for fraud and phoenix company activity. The MBR will unify the Australian Business Register and 31 ASIC business registers, including the register of companies. In effect, the system will create one source of truth across Government agencies for individuals and entities and will be managed by the Australian Taxation Office (ATO).

For those concerned about their privacy, the director ID will not be searchable by the public and will not be disclosed without the consent of the Director.

Who needs a director ID?

All directors of a company, registered Australian body, registered foreign company or Aboriginal and Torres Strait Islander corporation will need a director ID. This includes directors of a corporate trustee of self-managed super funds (SMSF).

You do not need a director ID if you are running a business as a sole trader or partnership, or you are a director in your job

title but have not been appointed as a director under the Corporations Act or Corporations (Aboriginal and Torres Strait Islander) Act (CATSI).

The company secretary or officeholder should keep a register of the IDs of their directors in a secure place - director IDs are governed by the same privacy rules that apply to Tax File Numbers (TFNs) and should not be disclosed unless required.

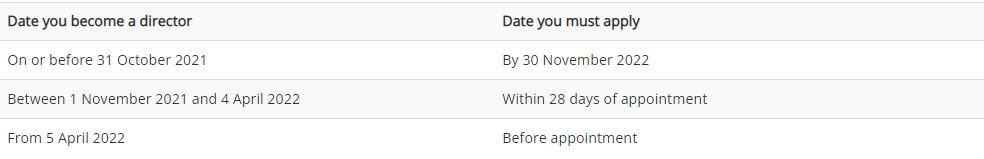

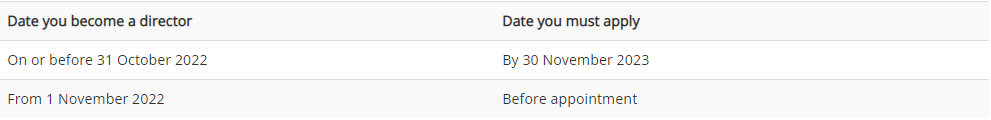

Timeframes for registration

For Corporation Act directors:

For CATSI directors:

If the company intends to appoint new directors, it will be important to ensure that they are aware of the requirements and timeframes to establish their director ID if they do not already have one.

How to set up a director ID

If you are an Australian resident director, you will need to complete a number of steps and have a number of identification documents available and ready (for non-resident directors see Foreign directors and the director ID system below).

1 Verify your identify

If you establish your director ID online, and you have not already set up myGovID, you will need to download the app onto your phone or device and create an account.

The myGovID does not create your director ID - the app’s only purpose is to validate your identity, and once validated, issue a code that can be used to identify you on government online services without going through the same verification process.

myGovID uses your phone/device’s camera to scan your forms of ID such as your passport, driver’s license and/ or VISA (check the documentation requirements here), to validate who you say you are. Be careful when you are scanning your documentation as the system does not always read the scan correctly.

2 Apply for your director ID through Australian Business Registry Services

Once you have set up your myGovID, you need to apply to the Australian Business Registry Services (ABRS) for your director ID. Use the email you used to create your myGovID to start the process.

In addition to your myGovID, you will need to have on hand documentation that matches the information held by the ATO. If you have a myGov account linked to the ATO, you can find the details on your profile. You will need:

Your tax file number

The residential address held on file by the ATO; and

Two documents that verify your identify such as:

Your bank account details held by the ATO (on your myGov ATO account, see ‘my profile/financial institution details’).

Dividend statement investment reference number

Notice of assessment (NOA) – date of issue and the reference number (on your myGov ATO account, see Tax/lodgements/income tax/history).

The gross amount from your PAYG payment summary

Superannuation details including your super fund’s ABN and your member account number

The final stage requests your personal contact details (not the company’s).

Once complete, your director ID will be issued immediately on screen. This information should be provided to your company secretary or office holder.

If any of your details change, for example a change of residential address or phone number, you will need to update your details through the ABR. You will also need to notify your company within seven days (14 days for CATSI Act directors) and the company will then need to notify the Australian Securities and Investments Commission (ASIC) within 28 days.

Applying by phone or using paper forms

You can choose to verify your identify and apply for your director ID by phone (13 62 50) or on paper. You will need to have your identification documents available. If you are applying using the paper form, your identify documentation will need to be certified by an authorised certifier such as a Barrister, Justice of the Peace etc.

Foreign directors and the director ID system

Foreign directors of Australian companies have the same requirements and deadlines as Australian resident directors, however, the verification process is only accessible in paper form.

One primary and two secondary forms of identification are required to accompany the application that have been certified by a notary publics or by staff at the nearest Australian embassy, high commission or consulate, including consulates headed by Austrade honorary consuls. Primary forms of identification include a birth certificate or passport, and secondary include driver’s licence, foreign government identifier, or national photo identification card.

In the presence of the applicant, the authorised certifier must certify that each copy is a true and correct copy of the original document by sighting the original document, stamping, signing and annotating the copy of the identity document to state, ‘I have sighted the original document and certify this to be a true and correct copy of the original document sighted'. initialling each page listing their name, date of certification, phone number and position.

The form and the accompanying documents will need to be sent by mail to Australian Business Registry Services using the details provided.

Directors in name only

It’s important that anyone agreeing to be a director understands the implications. Being a director is not just a title; it is a responsibility. At a financial level, directors are responsible for ensuring that the company does not trade while insolvent. The by-product of this is that the directors may be held personally liable for the debt incurred. The director penalty regime has also tightened up in recent years to ensure that directors are personally liable for PAYG withholding, net GST, and superannuation guarantee charge liabilities if the company fails to meet its obligations by the due date. For many small businesses, the directors are also often personally responsible for company loans secured against property such as the family home.

Failing to perform your duties as a director is a criminal offence with fines of up to $200,000 and five years in prison.

Ignorance is not a legal defence. Don’t sign anything unless you understand the consequences.

The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.